Last updated 17 month ago

The IRS says Microsoft owes $29 billion in returned taxes, but Redmond disagrees

The Internal Revenue Service (IRS) says Microsoft owes the U.S. Government almost $29 billion in again taxes. The declare comes after an extended-walking IRS audit into Microsoft's price range from the years 2004-2013 and facilities around a controversial practice called "switch pricing" that is reportedly used by groups to decrease their tax liabilities.

Microsoft disputes the IRS' claims and says it followed all policies and paid all of the taxes it ever owed, both within the U.S. And around the world. The company also claimed that it has been one of the top U.S. Company income taxpayers through the years, having paid over $67 billion in taxes to the authorities when you consider that 2004. Microsoft added that it will enchantment the IRS' choice, though the procedure could reportedly take "numerous years."

It is really worth noting that Microsoft has changed its corporate shape and practices because the years covered via the audit, meaning the inconsistencies found by using the IRS do now not practice to the agency's current practices. However, they're still very a good deal applicable to the audit duration, so it'll be thrilling to peer if Microsoft may be able to get away without footing the massive tax bill as claimed by way of the IRS.

According to Microsoft, many big corporations use the same 'fee-sharing' arrangement, which lets in them to percentage their earnings with non-American subsidiaries and pay decrease taxes inside the U.S. The exercise is completely felony, with the IRS having lengthy-installed policies that allow organizations to use fee-sharing even as reporting their earnings.

However, the exercise faces robust pushback from many critics, who argue that businesses need to pay higher taxes inside the nations they are based totally in, and must no longer be allowed to get away with reporting lower income in nations with better taxes, as well as better income in nations with lower taxes, to cynically lessen their tax liabilities.

The audit into Microsoft's financials began lower back in 2007, with the organization describing it as one among the biggest in its history. The probe ended "these days," with the IRS reputedly locating the agency susceptible to pay $28.9 billion in back taxes, plus penalties and hobby. Microsoft, but, says that the taxes it paid underneath the Tax Cuts and Jobs Act (TCJA) are not meditated within the IRS' figures, so the unpaid tax quantity could be lower by way of up to $10 billion.

Says owes additional billion back taxes

Microsoft net worth

Microsoft revenue

Babbel is down to $140 for a lifetime subscription

The blessings of speaking a 2d language are immeasurable – from establishing doors of communication to unlocking new profession possibilities – so it's no surprise that over 10 million humans use Babbel for self-paced l...

Last updated 17 month ago

Samsung's 990 EVO SSD should help both PCIe four.Zero x4 and PCIe five.0 x2

What just came about? Samsung Ukraine has apparently indexed the 990 Evo SSD on its professional website upfront, revealing some of the key specifications. The next-gen power is expected to debut within the near future,...

Last updated 15 month ago

Where did the call "Bluetooth" come from?

A medieval Scandinavian king An electric powered eel with blue teeth A endure that loves blueberries A Native American chieftain Choose your solution and an appropriate preference could be revealed. Cor...

Last updated 17 month ago

CDPR used AI to clone deceased Cyberpunk actor's voice in Phantom Liberty DLC

Why it topics: If you played Cyberpunk 2077, the name Viktor Vektor is most assuredly acquainted to you. Vektor was V's essential ripperdoc for the duration of the game. He became an NPC involved in several marketing ca...

Last updated 17 month ago

A fan-made Portal 2 VR mod is currently in improvement

After Half-Life 2 and its expansions received well-seemed VR mods, it appears natural that enthusiasts might bring the layout to Valve's different single-player first-character franchise. The Portal VR mod is in an ear...

Last updated 18 month ago

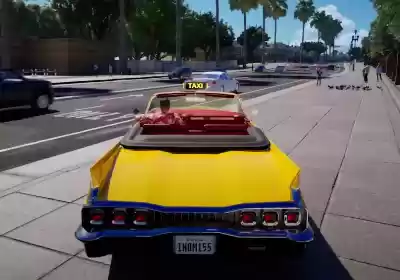

Sega is developing new versions of fan-favorites together with Crazy Taxi and Streets of Rage

What simply came about? Sega is popping to its again catalog for future game improvement thought, but it's now not Sonic the Hedgehog that'll be taking the lead this time. At The Game Awards 2023, the Japanese sport org...

Last updated 16 month ago